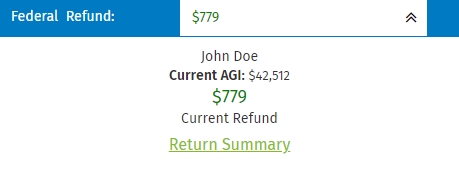

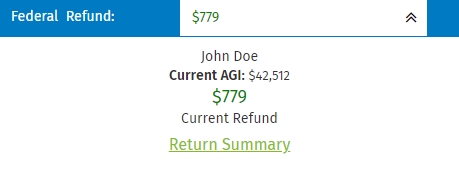

To quickly pull information about a particular return, use the following steps:

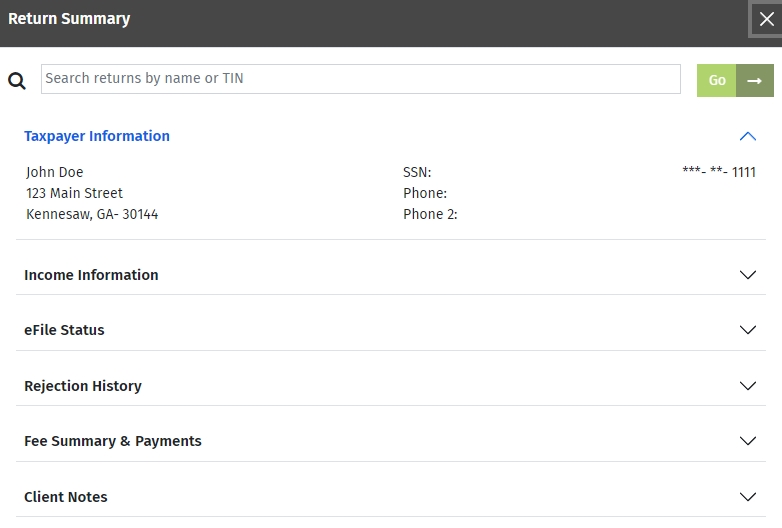

The window displays the following information for the selected return:

Click each section to expand and view additional information.

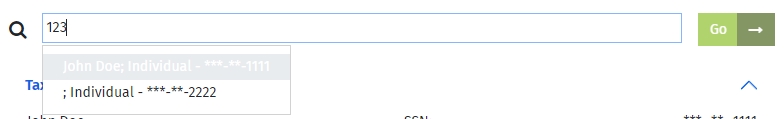

The Search returns by name or TIN section of the Return Summary allows you to quickly search for other returns and see the associated return summary.

The search is dynamic; as you enter the search criteria, a list of matching returns is displayed, allowing you to select the return you are looking for.

Select the return from the list shown and click Go.

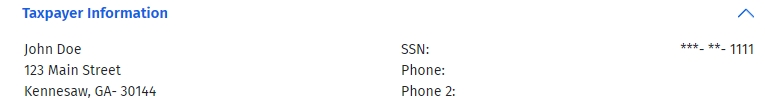

The Taxpayer Information section of the Return Summary displays the name, address, SSN, and phone numbers of the primary taxpayer as entered on the return.

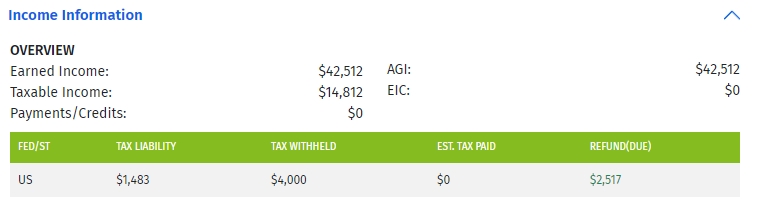

The Income Information section of the Return Summary displays an overview of the income, credits, refund, balance due, and more.

The eFile Status section of the Return Summary displays information relating to the electronic filing of the return.

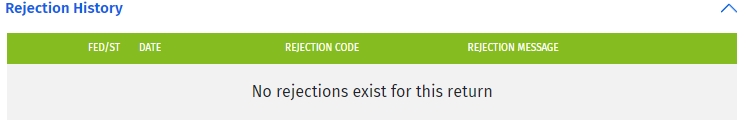

The Rejection History section of the Return Summary displays information relating to Federal and/or State rejections received for the return.

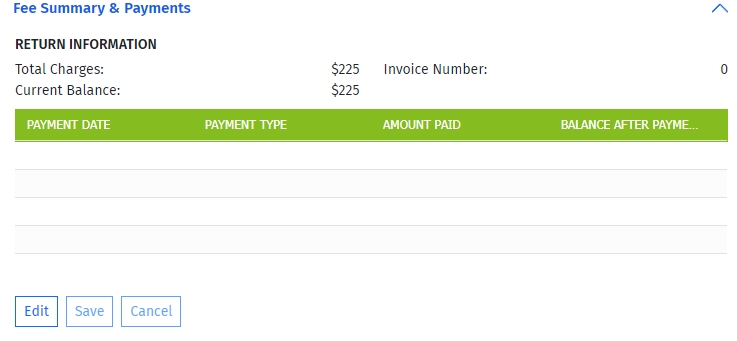

The Fee Summary & Payments section of the Return Summary displays charges for the return and allows you to enter payments.

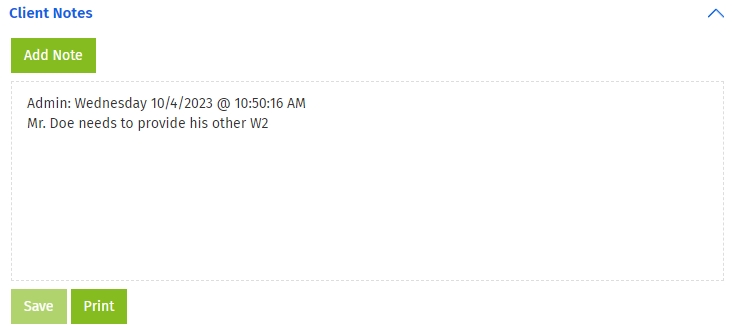

The Client Notes section of the Return Summary displays notes that have already been entered for the return and allows you to enter additional notes as needed.

See Also: